BlackRock is one of the most well-known investment and asset management companies in the world, based in New York City. Founded in 1988, it has quickly expanded worldwide, with a strong presence in the U.S., Asia, Brazil, and the Middle East.

Along with State Street and Vanguard, it is believed to control most global corporations through various investments.

In the first quarter of 2024, the company’s assets under management (AUM) hit a record $10.5 trillion, up $1.4 trillion year-over-year.

So, what does BlackRock’s ownership structure look like? In this article, we examine BlackRock’s major stakeholders and the number of BLK shares they own.

Let’s explore who owns the most BlackRock stock in 2024.

Key Takeaways

The diverse and strategic shareholder composition of BlackRock encompasses both influential individual shareholders, like its founders, and major institutional investors.

This mix highlights BlackRock’s robust market presence and underscores its appeal to a wide range of investors in the global financial landscape.

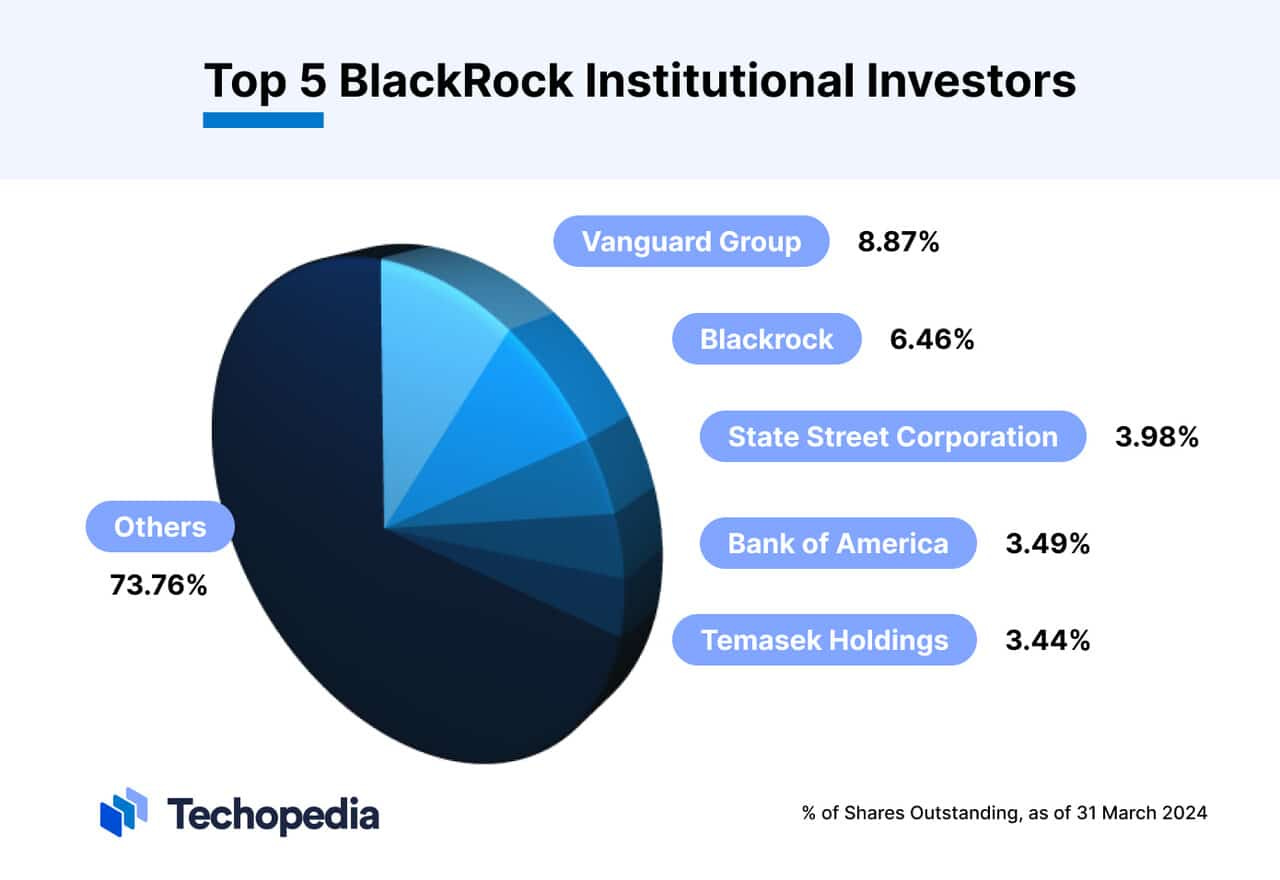

BlackRock’s largest institutional shareholders are Vanguard Group, BlackRock itself, State Street Global Advisors, Temasek Holdings, and Bank of America.

Blackrock’s investment in its BLK shares represents only a tiny fraction (0.2%) of the company’s holdings. As of Q1 2024, the top five Blackrock holdings included Microsoft (5.3%), Apple (4.2%), Nvidia (3.8%), Amazon (2.7%), and Meta Platforms (1.8%).

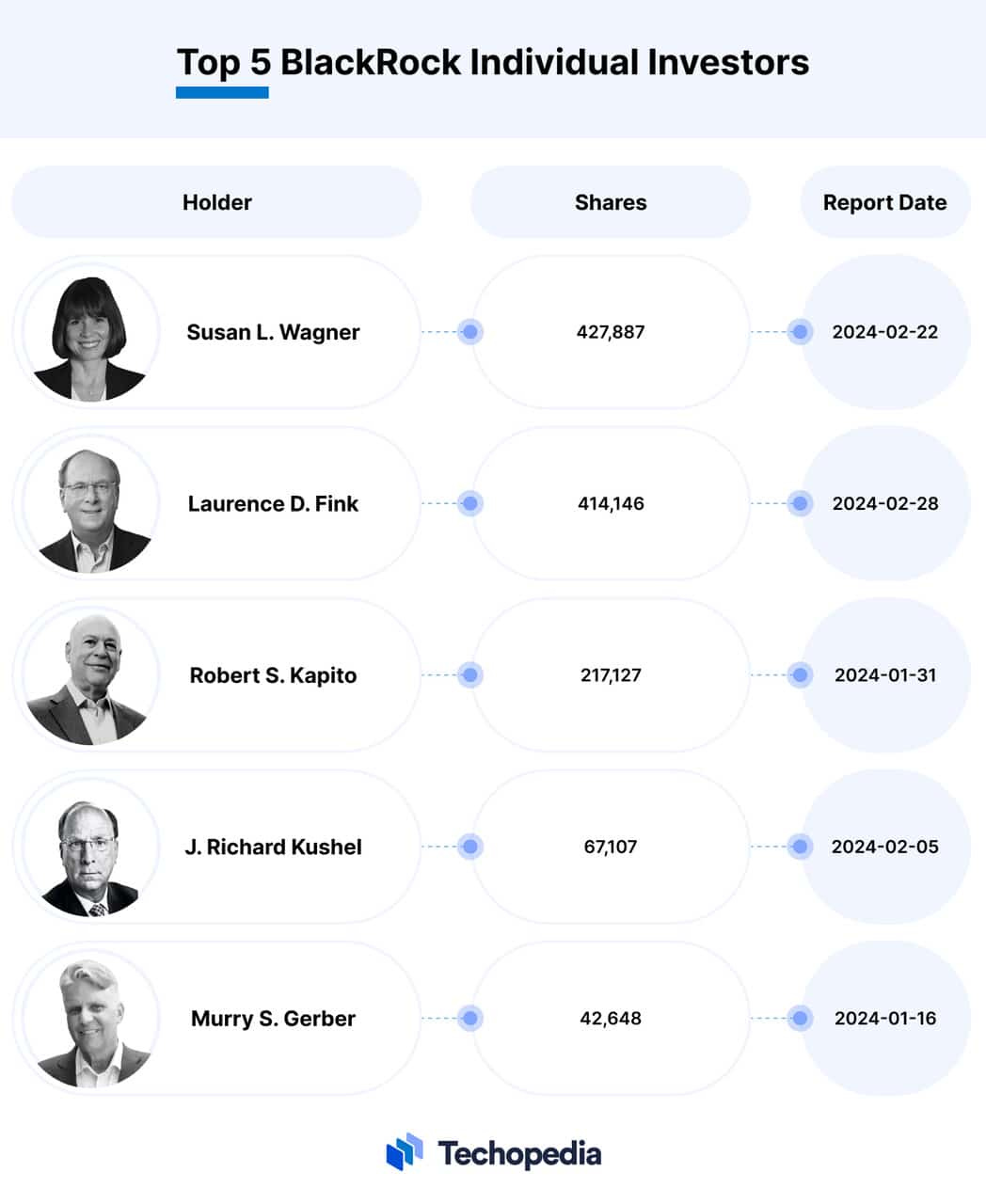

The company’s largest individual shareholders include original BlackRock owners and founders Larry Fink and Susan L. Wagner, Robert S. Kapito, as well as its top executives Richard Kushel and Murry S. Gerber.

Blackrock declared a quarterly cash dividend of $5.10 of common stock, payable on June 24, 2024.

As of April 30, 2024, the company had 148,599,981 shares outstanding, considerably less than its competitors, such as Bank of America, Invesco, or UBS.

At the time of writing, its stock was trading at $718.13 per share. The company had a market capitalization of about $116.07 billion.

The company’s revenues clocked in at about $17.859 billion for the full year 2023, and $4.728 billion for the Q1 2024, according to BlackRock’s latest financial reports.

On May 15, Blackrock declared a quarterly cash dividend of $5.10 per share of common stock, payable on June 24, 2024, to shareholders of record at the close of business on June 7, 2024.

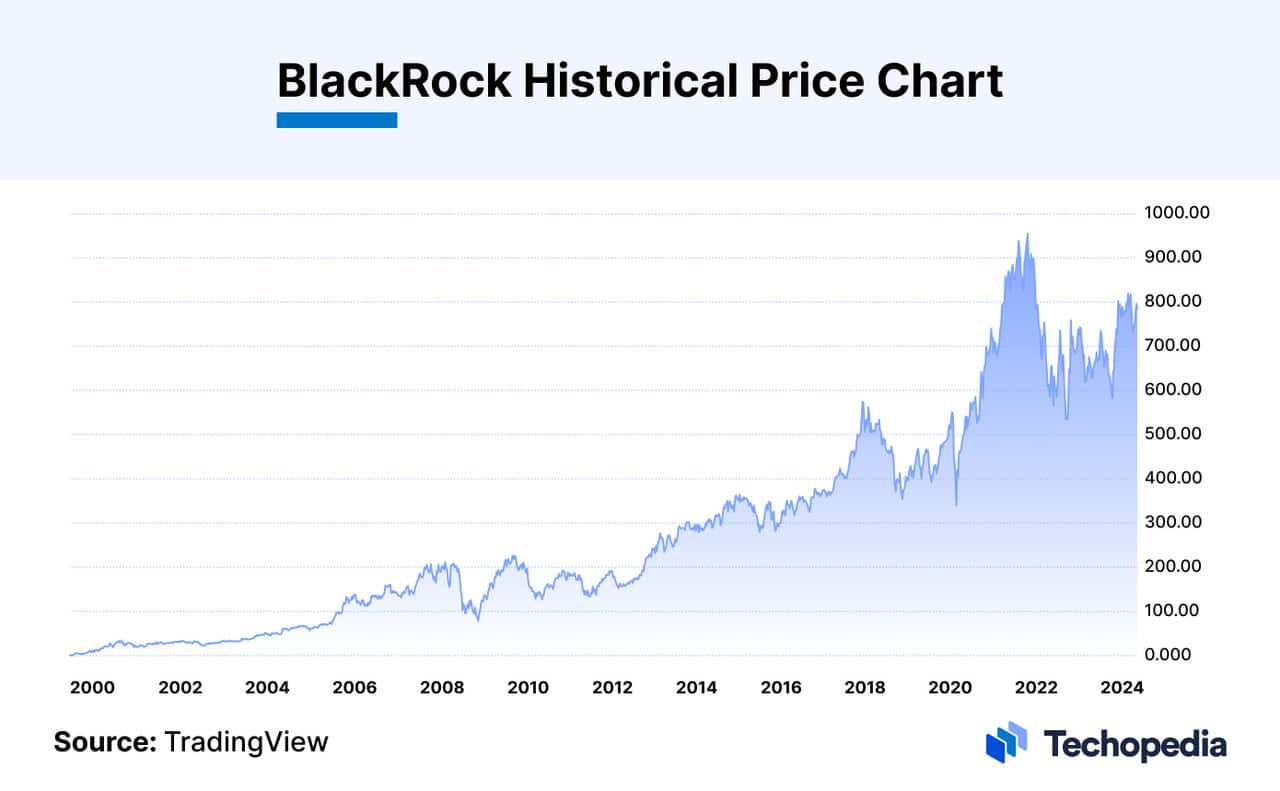

As of June 28, 2024, BlackRock (BLK) stock appreciated by 5,022.16%, according to data from TradingView.

Note that past performance is not indicative of future results.

But who are the stakeholders of BlackRock?

The shareholders are divided into Investor A, Investor B, Investor C, Institutional, and Class R shares. The type of ownership, sales charge, management fees, and other operating expenses can vary depending on the type of share purchased.

BlackRock shareholders are also classified into individual and institutional shareholders.

BlackRock has 2,824 institutional owners and shareholders that have filed 13D/G or 13F forms with the U.S. Securities and Exchange Commission (SEC). These institutions hold a total of 136,830,864 shares, according to the data compiled by Fintel.io as of June 28, 2024.

Who Owns BlackRock?

Top 5 Largest Institutional BlackRock Shareholders

Institutional investors are the largest owners of Blackrock shares. Amongst BlackRock’s major shareholders are investment and asset management companies like Vanguard Group and State Street Global Advisors, which have some of the largest stakes.

BlackRock has a higher percentage of institutional shareholders than other similar investment companies. Currently, institutional investors hold 51.78% of the company’s stock.

Out of these, the top 5 largest BlackRock owners are outlined below, with holdings as of 31 March 2024.

5. Temasek Holdings – 5,115,491 – 3.44%

Temasek Holdings, owned by the Government of Singapore, possesses a 3.44% stake in BlackRock. This equates to approximately 5,115,491 shares, valued at around $4.26 billion.

In 2023, Temasek Holdings led a $140 million funding round for Ola Electric.

According to the latest news, Temasek Holdings has recently backed a new $250 million tech fund, Alpha Intelligence Capital (AIC), which invests in artificial intelligence companies, including OpenAI.

4. Bank of America – 5,196,941 – 3.49%

Bank of America is one of the biggest BlackRock shareholders, with a 3.49% stake in Blackrock, which amounts to 5,196,941 shares valued at approximately $4.33 billion.

In contrast to other Wall Street banks, Bank of America has been avoiding job cuts until recently.

However, as the layoff trend continues, Bank of America has started a round of job cuts, following its rivals Citigroup, Goldman Sachs, and Morgan Stanley, which collectively cut over 10,000 roles last year.

3. State Street Global Advisors – 5,928,745 – 3.98%

State Street Global Advisors holds a 3.98% stake in BlackRock, equivalent to about 5,928,745 shares valued at approximately $4.94 billion. This stake makes State Street the third-largest BlackRock owner among institutional shareholders.

The company offers exchange-traded funds (ETFs) such as the SPDR S&P 500 Ucits ETF and the SPDR S&P 500 ESG Leaders Ucits ETF. Recently, State Street Global Advisors reduced the fees for these two funds, positioning them among the most cost-effective options for tracking the S&P 500 Index.

This decision is seen as a strategic and forward-thinking move, particularly in a market where investors are increasingly well-informed about the variety of funds and fee structures available.

2. BlackRock – 9,604,250 – 6.46%

BlackRock owns a 6.46% stake in BlackRock, totaling approximately 9,604,250 BLK shares with an estimated value of $8 billion. This amount makes BlackRock the second-largest institutional shareholder of its own company.

But what does BlackRock own besides BLK stock?

Blackrock’s investment in its BLK shares represents only a tiny fraction (0.2%) of the company’s holdings. As of Q1 2024, the top five Blackrock holdings included Microsoft (5.3%), Apple (4.2%), Nvidia (3.8%), Amazon (2.7%), and Meta Platforms (1.8%).

1. Vanguard Group – 13,182,262 – 8.87%

The Vanguard Group holds an 8.87% stake in BlackRock, equivalent to around 13,182,262 shares valued at approximately $10.9 billion.

These shares are distributed across various mutual funds and ETFs managed by Vanguard, including the Vanguard 500 Index Fund, the Vanguard Total Stock Market ETF, and the Vanguard Value ETF.

Top 5 Largest Individual BlackRock Shareholders

Amongst the individual shareholders of BlackRock, the founders and long-time employees of the company hold the most shares. This was because BlackRock famously implemented a strategy of offering equity options to new employees it hired.

Although this caused friction amongst the early management, it is a practice that still holds true and attracts some of the best talent in the world.

Below, we highlight the key individuals who not only hold substantial shares in the company but have also played pivotal roles in its growth and operations.

5. Murry S. Gerber – 42,648 – 0.02%

Murry S. Gerber has been serving as BlackRock’s Lead Independent Director since 2017.

BlackRock has recently announced that Murry S. Gerber decided to not stand for re-election at the conclusion of his term in May 2024 and retire after 23 years of service to the firm and its shareholders.

Before BlackRock, Gerber held prominent positions at EQT Corporation, including Chairman, Executive Chairman, President, and CEO. His extensive leadership experience also includes a tenure as CEO of Coral Energy.

Additionally, Gerber contributes to the cultural sector as a member of the board of trustees of the Pittsburgh Cultural Trust.

According to his latest SEC filing, Murry S. Gerber owned 42,648 shares of BlackRock as of January 16, 2024.

4. Richard Kushel – 67,107 – 0.04%

Richard Kushel holds the position of Senior Managing Director at BlackRock, where he also oversees the Portfolio Management Group.

His expansive role at BlackRock includes past leadership as the Head of Multi-Asset Strategies and Global Fixed Income. Additionally, Kushel has significantly contributed to the company’s growth in his former capacities as Chief Product Officer and head of the Strategic Product Management Group, BlackRock Investment Stewardship, and the BlackRock Investment Institute.

As of May 02, 2024, Richard Kushel owned 67,107 shares in the company.

3. Robert S. Kapito – 217,127 – 0.14%

Robert Kapito is the President and director of BlackRock. He is distinguished as one of the eight founders of the company. In his extensive leadership roles, he chairs the Global Operating Committee and is a member of the Global Executive Committee. Additionally, Kapito holds a director position at iShares.

His key responsibilities include overseeing Risk and Quality Analysis, Investment Strategies, Technology and Operations, as well as Client Business.

Robert Kapito owned 217,127 shares as of January 31, 2023. This stake makes him the third-largest individual BlackRock owner.

2. Larry Fink – 414,146 – 0.27%

Larry Fink, one of the original eight Blackrock owners and founders, currently holds the positions of CEO and Chairman and is the second-largest individual shareholder of the company.

As of February 28, 2024, he held 414,146 shares of the asset management firm.

In his 2024 annual letter to shareholders, Larry Fink shared a very personal story of his parents’ successful investments and how they “could have lived beyond 100 and comfortably afforded it.”

Their experience reminded Fink why he founded BlackRock in the first place. He said:

“Obviously, we were ambitious entrepreneurs, and we wanted to build a big, successful company. But we also wanted to help people retire like my parents did. That’s why we started an asset manager — a company that helps people invest in the capital markets — because we believed participating in those markets was going to be crucial for people who wanted to retire comfortably and financially secure.”

In an interview with CNBC’s Jim Cramer, BlackRock CEO Larry Fink said he’s hopeful about the younger generation despite a looming retirement crisis.

1. Susan L. Wagner – 427,887 – 0.28%

Susan Wagner, celebrated as one of the original founders of BlackRock, has served in various significant roles within the company, including Head of Corporate Strategy, Chief Operating Officer, and Vice Chairwoman.

Wagner played a crucial role in expanding BlackRock’s reach into international markets such as Brazil, Asia, and the Middle East. Even after retiring, she continues to serve on BlackRock’s board.

In addition to her contributions at BlackRock, Wagner is a member of the board of trustees at Hackley School and holds positions on the boards of both Swiss Re and Apple.

As of February 22, 2024, she held 427,887 shares in BlackRock, which makes Wagner the largest individual BlackRock owner at the time of writing.

[…]

Perhaps, Heretic, but they received lots of assistance from Europe's black nobility.

I think Blackrock, like the other investment behemoth Vanguard, is a creation and adjunct of the Rothschild banking dynasty. The Tribe literally owns this earth. Their daddy, the Demiurge who created it, must have given it to them as a Hanukkah gift.